As the fiscal year draws to a close, businesses and organizations face an essential task: year-end accounting. Properly closing out the fiscal year is crucial for financial accuracy, compliance, and strategic planning. To help you navigate this process successfully, here’s an essential year-end accounting checklist:

- Review Financial Statements: Begin by thoroughly reviewing your financial statements, including the income statement, balance sheet, and cash flow statement. Ensure all transactions are accurately recorded.

- Reconcile Bank Accounts: Reconcile all bank and credit card accounts to verify that your recorded balances match the actual balances. Investigate and rectify any discrepancies.

- Update Depreciation and Amortization: Review your fixed assets and update depreciation and amortization schedules as necessary. This ensures accurate financial reporting and tax compliance.

- Assess Bad Debts: Review accounts receivable and assess the likelihood of collecting outstanding invoices. Make provisions for bad debts if necessary.

- Inventory Valuation: Conduct a physical inventory count and adjust inventory values accordingly. Choose an appropriate valuation method (e.g., FIFO, LIFO) and apply it consistently.

- Prepaid Expenses and Accruals: Review prepaid expenses and accrued liabilities. Make necessary adjustments to recognize income and expenses in the correct period.

- Record Depreciation: Depreciate capital assets in accordance with accounting standards and tax regulations. This can have a significant impact on your financial statements.

- Review Payroll Records: Verify that employee salaries, benefits, and payroll taxes are accurately recorded. Ensure compliance with tax withholding and reporting requirements.

- Reconcile Sales and Expenses: Reconcile revenue and expense accounts to ensure all income and expenses are accounted for. Address any discrepancies promptly.

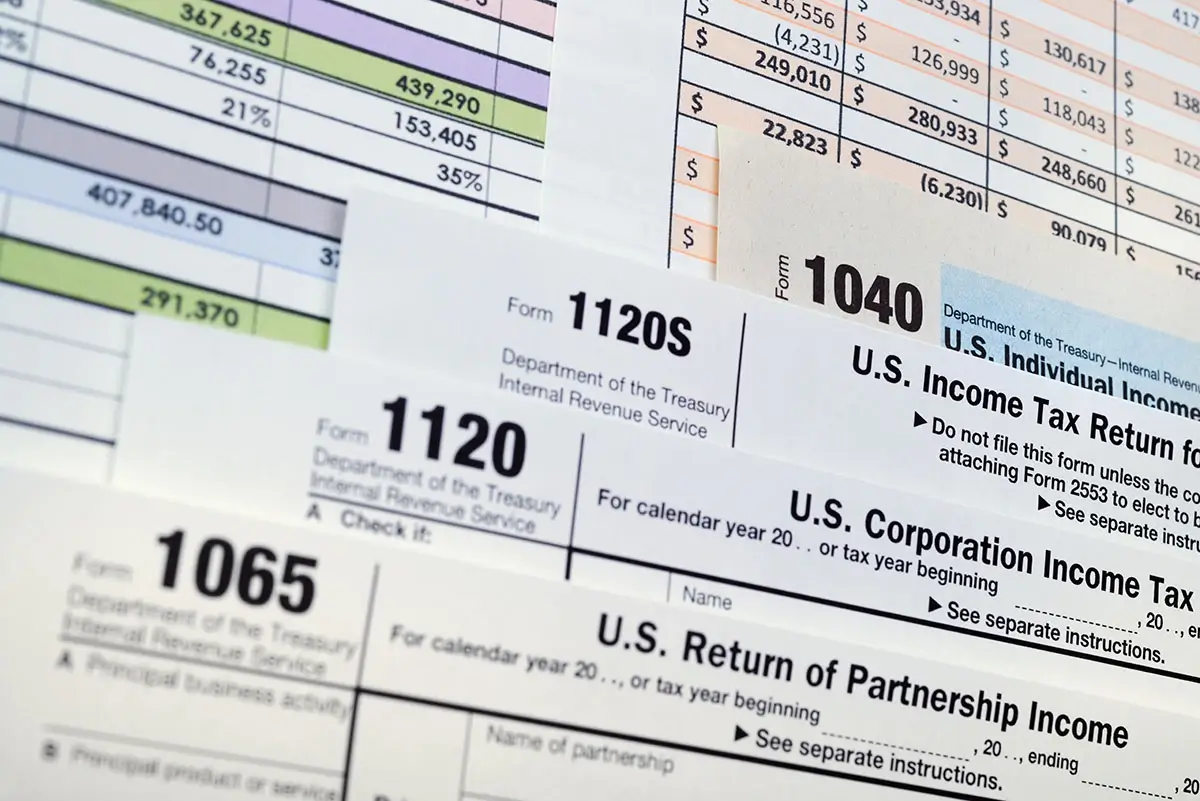

- Evaluate Tax Strategies: Consult with a tax professional to evaluate year-end tax strategies. This may include maximizing deductions, taking advantage of tax credits, and planning for estimated tax payments.

- Analyze Profit and Loss: Examine your profit and loss statement to identify trends and areas for improvement. Use this analysis to set financial goals for the upcoming year.

- Update Financial Projections: Update your financial forecasts and budgets based on the year-end results. This will help you plan for the next fiscal year more accurately.

- Compliance Checks: Ensure compliance with all relevant financial regulations, including Generally Accepted Accounting Principles (GAAP) and tax regulations. This is crucial for audits and financial transparency.

- Vendor and Contractor Payments: Verify that all payments to vendors and contractors are correctly recorded and that you have filed necessary tax forms such as 1099s.

- Organize Financial Records: Organize all financial records, including receipts, invoices, and supporting documentation, in preparation for audits or inquiries.

- Communicate with Stakeholders: If applicable, communicate your year-end financial results to stakeholders, such as shareholders, partners, or board members.

- Plan for the New Year: Use your year-end accounting data to set financial goals and strategies for the upcoming fiscal year. Consider capital investments, debt management, and revenue growth plans.

By diligently following this year-end accounting checklist, you can ensure financial accuracy, compliance, and a strong foundation for the fiscal year ahead. Whether you’re a small business owner or a financial manager in a large organization, closing out the fiscal year effectively is vital for making informed decisions and achieving long-term financial success. If you have questions or need help, please give us a call.