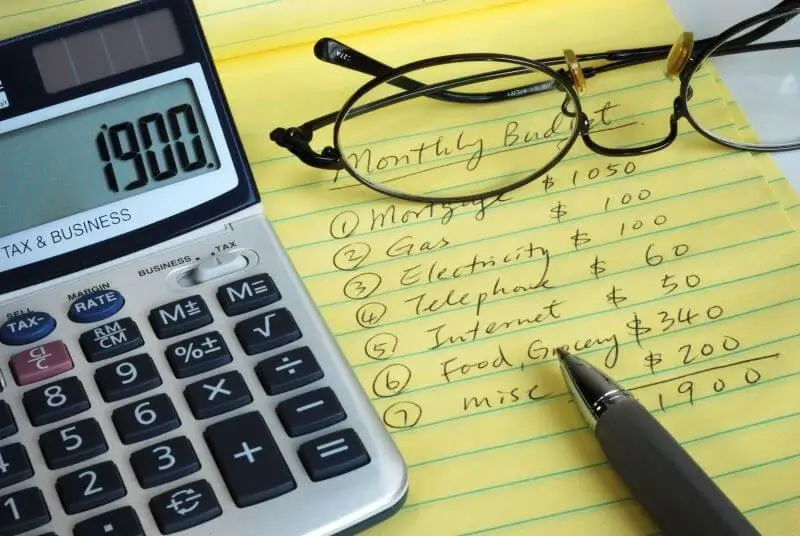

You have created your budget. The big question is how do you stick to it? There are many ways to do this, with the most important thing is remembering your goals. Ask yourself where you want to be and keep that top of mind as you move toward achieving financial freedom!

Keep Tabs on Your Spending

- Don’t spend more than you have allocated for each category

- Brown bag your lunch

- Make coffee at home (invest in a good coffee machine, the investment will pay off in a month from what you spend at the coffee shop)

- Stick to your grocery/shopping list. If it isn’t on the list don’t buy it.

- Use Cash

- Set an envelope each month for your expenditures and don’t spend more than what is there. Allot cash for these main categories:

- Groceries

- Gas

- Entertainment

- Exercise outside and forgo the gym membership

- Pay yourself first. Put your savings aside before you pay your other categories.

- If you come in under budget, save the rest. Every little bit adds up!

- Don’t impulse buy. If you need or want to make a purchase, sleep on it. How many hours will it take to make the money to buy it? Is it worth it?

- If you make a purchase on your credit card account for it in your checking account, that way when the bill comes in it is already paid for.

- Cut your utilities. Turn off every light and appliance when they are not needed or in use.

Be Realistic

- If you find yourself being too limited for some purchases or activities, you will need to adjust your budget. Is there somewhere else you can save to reallocate? If not, how can you cut down on this over time? Set yourself a 6-month goal to reduce by 15% each month.

- Plan ahead. Plan out your meals a week ahead of time and go to the grocery store once a week. How can you buy something once and use it in 2 or 3 ways? Roast a whole chicken on Sunday, then turn it into a casserole on Tuesday and a soup on Thursday.

- Set up auto-deposit for savings. When you get paid, set up an automatic payment that will move money to a savings account. Set up a different savings account not attached to your main checking so you can’t see the money. That way, you won’t be tempted to spend it.

Remember, sticking to a budget is not a “set it and forget it” process. You need to check in each week or month to see how you are doing and make adjustments. The biggest piece to sticking to a budget is keeping yourself accountable. If you have questions or need help, please contact us to set up a consultation.