Managing taxes is often a top concern for small business owners. Taxes can feel overwhelming, but with the right planning and strategies in place, you can minimize your tax burden and keep more money in your pocket. Below, we’ll explore the benefits of tax planning, some common tax surprises that you can avoid, and how working with a professional accountant can help ensure your taxes are in order.

Benefits of Tax Planning

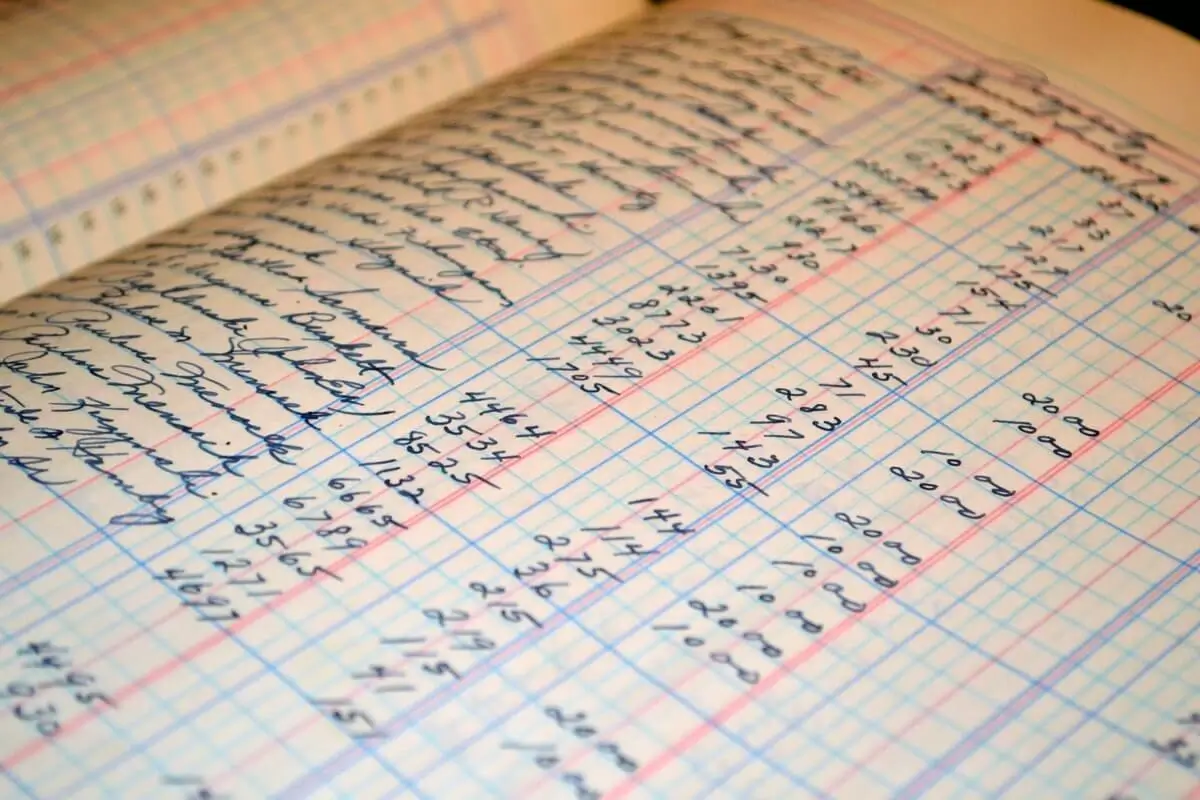

Tax planning is an essential part of running a small business. It’s not just about filing your taxes on time—it’s about making strategic decisions throughout the year that can help you reduce your overall tax liability. Proper tax planning can lead to substantial savings and financial peace of mind. Here are some key benefits:

- Maximizing Deductions: Tax planning allows you to take advantage of deductions and credits you might not be aware of. Whether it’s business-related expenses like office supplies, equipment, or even your vehicle, planning ahead ensures you’re claiming everything you’re entitled to.

- Avoiding Late Fees and Penalties: One of the easiest ways to avoid costly mistakes is by planning ahead. When you understand your tax obligations, you can avoid late payments and missed deadlines, which can result in fines and penalties.

- Tax-Efficient Growth: As your business grows, tax planning becomes even more important. With careful planning, you can structure your business in ways that minimize taxes and help you reinvest in your company.

- Predictability: Tax planning helps provide a clear picture of your financial future, allowing you to plan for business expenses, expansions, and retirement savings without the surprise of a hefty tax bill at the end of the year.

Surprises Taxes You Can Avoid

When taxes are filed without proper planning, business owners are often caught off guard by unexpected liabilities. Here are some common tax surprises you can avoid by being proactive:

- Self-Employment Tax: Many small business owners overlook the self-employment tax, which can be a substantial portion of their tax liability. Self-employed individuals are responsible for both the employer and employee portions of Social Security and Medicare taxes, so understanding this obligation is key to budgeting correctly.

- Quarterly Estimated Taxes: If you’re self-employed or run a small business, you’re required to pay estimated taxes quarterly. Failing to do so could result in penalties. However, with careful planning, you can determine your estimated tax payments and avoid any unpleasant surprises come tax season.

- Changes in Tax Laws: Tax laws frequently change, and business owners may not always be up-to-date on the latest regulations. For instance, the availability of deductions, tax credits, and even the tax rates themselves can vary from year to year. Without staying on top of these changes, you may miss opportunities to save.

- Underestimating Deductions: Without proper tax planning, you might miss out on valuable deductions that can lower your taxable income. Common deductions for small businesses include home office deductions, business travel expenses, and even the costs associated with continuing education.

Contact Intentional Accounting to Plan Your Taxes

Tax planning isn’t something that should be left to chance. It’s a year-round process that requires a keen understanding of your business’s financials and current tax laws. That’s where Intentional Accounting can make a difference. Our team of experienced accountants specializes in helping small businesses maximize their tax savings and avoid common pitfalls. Contact us today to schedule a consultation and begin planning your tax strategy. Take control of your small business taxes with Intentional Accountingv!