Charities and Nonprofits.

Filing Requirements for Nonprofits

Not-for-profit organizations have unique requirements for accounting, issues of compliance, and reporting to the Internal Revenue Service. We have staff experienced in these differences from what other businesses require. Our team can assist charities and nonprofits with their bookkeeping, payroll, and tax preparation needs, as well as other filing and consultation services specific to these organizations. We have partnered with an experienced nonprofit auditor and can work in conjunction with her when services arise that we do not offer in-house. We also have the mindset that nonprofits are vital components of our communities and as community members, parents, volunteers and more; it is our professional, civic, and social duty to provide the best services possible for these organizations.

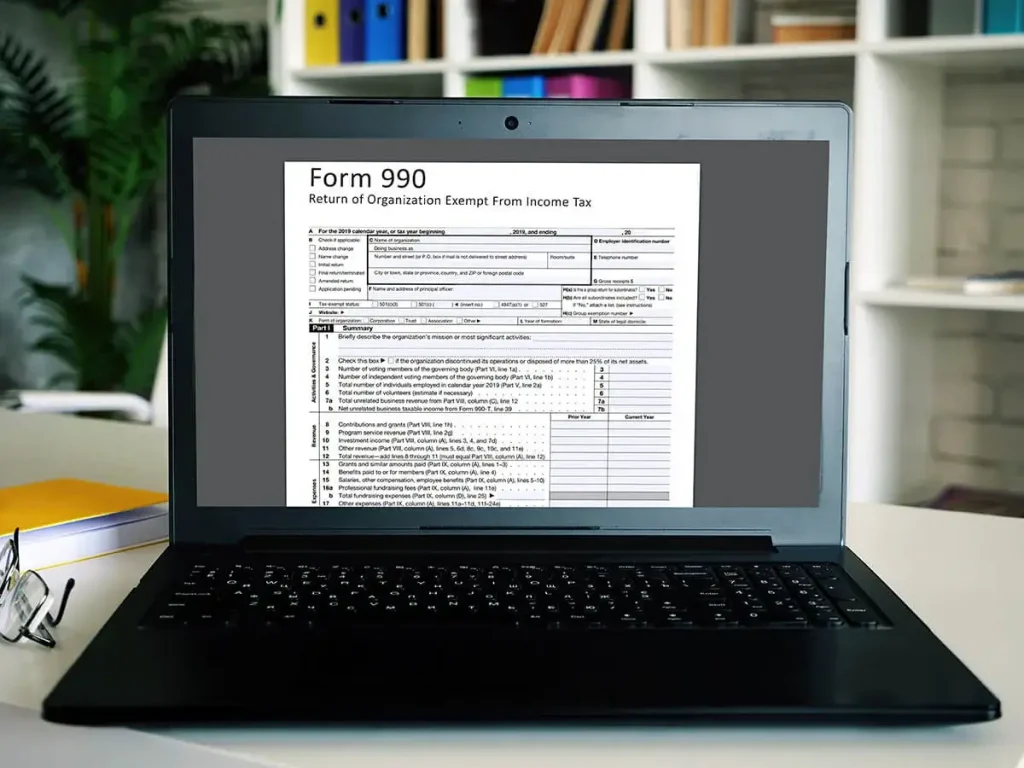

For anyone new to not-for-profits, they do not file traditional tax returns but instead file what is considered an information return known as a 990: Return of Organization Exempt From Income Tax. There are several versions of this, including the 990-T which is used for organizations that do have taxable income. 501 (c)(3) and 501 (c)(4) organizations are required to report both natural and functional expenses when filing a full 990.

It is important to have a Preparer who is familiar with the components of the Form and is familiar with annual reporting changes to ensure that it is prepared properly. The Forms 990 are public documents and contain a substantial amount of financial and other information. If it is not prepared completely and accurately, the IRS may consider it not filed and penalties may accrue daily. The IRS recently stated that for the 2019 returns, they will have a renewed focus on reviewing returns and will reject those they deem inaccurate or incomplete. MCA is here to help relieve any stress in preparing your returns and will work with you to ensure all information is complete.

Services we offer charities and nonprofits include, but are not limited to:

- Preparation and filing of Forms 1023, 1023-EZ, or 1024 for creation of a not-for-profit entity

- Assistance with Virginia Charitable Registration Forms

- Review of and consulting on 990 preparation, compliance issues, and resource guidance