Cash basis accounting is an accounting system for businesses that recognizes revenues and expenses only when cash is exchanged. Businesses will account for their income and expenses at the time they actually receive payment or at the time when an expense is paid for. The cash basis accounting system does not consider income from credit accounts or past due accounts.

The cash system of recording transactions is really designed only to be used by individuals and small businesses that deal exclusively in cash. Cash basis accounting is not acceptable under the Generally Acceptable Accounting Principles (GAAP) or the International Financial Reporting Standards (IFRS).

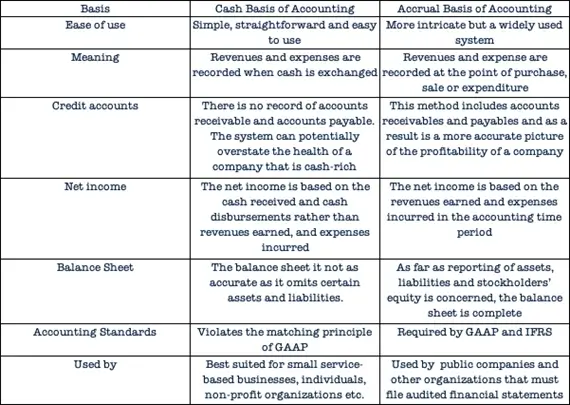

What Is the Main Difference Between Cash and Accrual Accounting?

While cash basis accounting recognizes your business’s revenues and expenses only when cash is collected or disbursed, the accrual basis of accounting recognizes revenues and expenses when they occur.

In accrual method accounting, accounts receivable and accounts payable are used to track amounts due from customers on credit sales and the amount your business owes to your vendors on a credit purchase.

The choice your business uses for their accounting system will have a major impact on the operations of your business. Here are some of the key differences between cash and accrual method accounting.

There are some common reasons why businesses may use cash basis accounting:

- The business uses simple single-entry accounting rather than a double-entry accounting

- The company operates as a sole proprietorship and it does not publish financial statements that need to be audited

- At the time of sale, your customers only pay by cash, check or credit/debit card

- Your business does not deliver goods and services on credit terms

- Your business only has a few financial transactions each day

- Your business has no or very few employees

- Your business has no inventory that needs to be tracked or valued

There are benefits to both methods, however it truly depends on how your business operates as to which method of accounting will work best for your business.