For self-employed professionals, freelancers, and small business owners, quarterly taxes aren’t optional — they’re a critical part of staying compliant with the IRS. Unlike traditional employees whose taxes are automatically withheld from each paycheck, individuals responsible for quarterly taxes must estimate and submit payments four times a year. Missing a payment or miscalculating your tax liability can lead to penalties, interest, and unnecessary stress. However, with some planning and organization, Intentional Accounting can help make your quarterly taxes manageable and even stress-free.

What Are Quarterly Taxes?

Quarterly taxes, also called estimated taxes, are payments made to the IRS and, in many cases, state tax agencies on income not subject to withholding. This typically includes self-employment income, rental income, dividends, interest, capital gains, and other sources outside of traditional employment. Payments are due four times a year, so it is helpful to note these dates to stay on track and reduce the stress of filing your business’s taxes.

- April 15 – for income earned January 1 through March 31

- June 15 – for income earned April 1 through May 31

- September 15 – for income earned June 1 through August 31

- January 15 (of the following year) – for income earned September 1 through December 31

Paying quarterly helps you avoid a large tax bill at the end of the year, and it reduces penalties for underpayment. It also provides a better way to manage cash flow by spreading your tax liability across the year. The better you plan, the more you can get out of your taxes.

Why Paying Quarterly Taxes Matters

Failing to make quarterly payments can result in significant consequences. The IRS may charge penalties and interest if you underpay, which can quickly add up. Moreover, waiting until the end of the year to pay your full tax liability can create financial stress, especially if your income has fluctuated. Regular quarterly payments make it easier to budget for taxes and reduce the chance of surprises come tax season.

Tips for Stress-Free Quarterly Filing

- Keep Accurate and Organized Records

Keeping detailed records of your income, expenses, and receipts is essential. Whether you use accounting software or a simple spreadsheet, consistent record-keeping ensures you don’t miss any deductions and can accurately calculate your estimated taxes. - Estimate Your Taxes Carefully

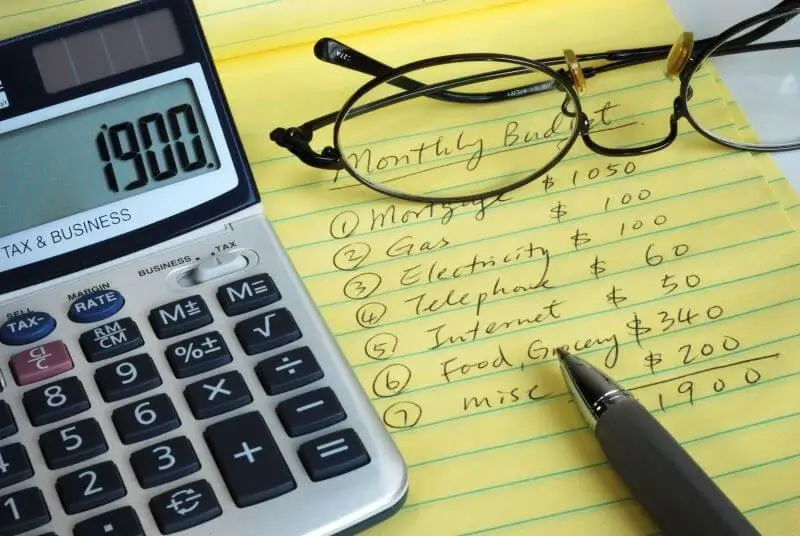

Accurately estimating your taxes is key to avoiding penalties. Your previous year’s tax return can serve as a helpful starting point, but make sure to adjust for changes in income or expenses. The IRS provides Form 1040-ES, which includes worksheets to help calculate estimated payments. If you’re unsure, slightly overestimating is often safer than underestimating. - Set Aside Funds Regularly

Many self-employed individuals find it helpful to set aside a portion of each payment received into a dedicated tax savings account. This ensures that, when quarterly taxes are due, funds are readily available and eliminates last-minute scrambling. - Automate Payments

Electronic payments through the IRS or your state tax agency make the process easier and reduce the risk of missing deadlines. Scheduling payments in advance helps you stay on track and reduces the stress of manual filing. - Work With a Tax Professional

Consulting with a CPA or tax advisor can simplify the process. A professional, like Intentional Accounting, can help identify all applicable deductions, accurately estimate payments, and guide you through more complex tax scenarios. While there’s a cost associated with professional help, it often saves time, money, and stress in the long run.

The Bottom Line on Quarterly Taxes

Quarterly taxes don’t have to be overwhelming. By staying organized, planning ahead, and leveraging the right tools, you can manage your tax obligations confidently and avoid surprises at the end of the year. The Intentional Accounting team specializes in helping self-employed individuals and business owners simplify tax season, providing guidance and support tailored to your unique situation. With the right approach, filing quarterly taxes can be a straightforward, stress-free part of running your business. Let Intentional Accounting guide you to a more stress-free tax year today!