Businesses that fall under the C-Corp tax bracket are often subjected to this hidden tax that can cost businesses thousands of dollars in taxes despite being quite simple to fix. The IRS, as we all know, is frustrating to work with all those different forms and requirements you have to fill out and adhere to. Well, unfortunately the IRS has one other requirement in order to avoid the hidden tax, and at Intentional Accounting, we are here to help you navigate through it. Find out what the hidden tax is and how to avoid it by reading this article.

What is the Hidden Tax?

The hidden tax, officially known as the Accumulated Earnings Tax (AET), is an often-overlooked tax that can catch C-corporations off guard. This tax is imposed when a corporation retains earnings within the company without properly justifying its purpose to the IRS. In essence, it discourages businesses from hoarding cash rather than distributing it as dividends or reinvesting it in the business. The reason why it’s called a hidden tax is because it easily blends in with all your other taxes and cannot be located without an IRS audit explaining what the tax is.

The IRS is notorious for its strict scrutiny of financial documentation. If your records or explanations for retained earnings are insufficient, your company could face this additional tax. Therefore, ensuring your financial documents are accurate, well-organized, and compliant with IRS standards is essential before submission.

What are Accumulated Earnings?

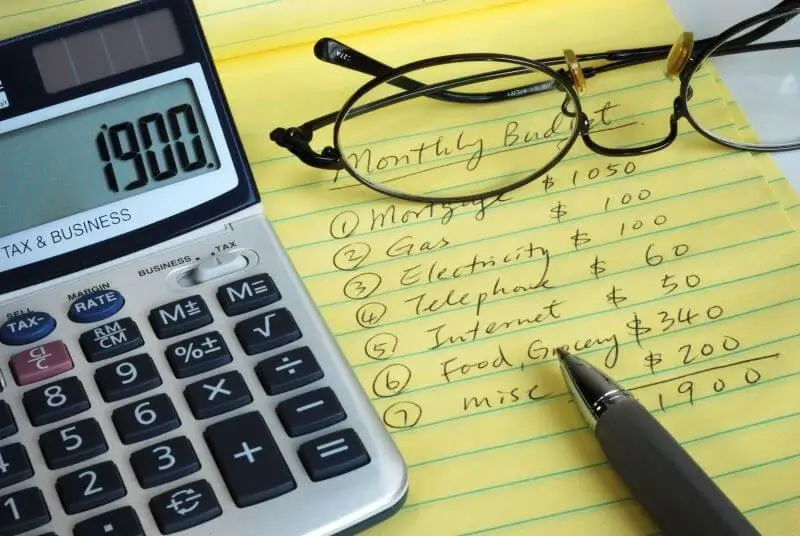

Accumulated earnings refer to profits that a business decides to keep within the company rather than distribute to shareholders as dividends or invest elsewhere. While retaining earnings can be a sound financial strategy, the IRS requires C-corporations to provide valid reasons for holding onto this cash.

How to Combat the Hidden Tax

To avoid triggering the Accumulated Earnings Tax, you must clearly articulate why your company needs to retain profits. They require 12 valid reasons, which we can provide you and your company with, as some reasons are not valid in the IRS’s eyes. Every company is different, and therefore, every company will have 12 different reasons. But through Intentional Accounting’s tax planning services we can help you avoid the hidden tax and save thousands of dollars in your accumulated earnings.

Why Does This Tax Exist?

The IRS closely monitors retained earnings to ensure they are not being used to improperly avoid taxes. If your explanations lack sufficient detail or appear unjustified, the agency may impose the Accumulated Earnings Tax. To safeguard your company, consult a tax professional or accountant to ensure your documentation aligns with IRS expectations.

By understanding the rules surrounding the Accumulated Earnings Tax and preparing clear justifications, your business can retain profits responsibly while avoiding unnecessary penalties.

What is a C-Corp?

A C-Corp is a tax bracket that many businesses fall under. C-Corp companies are ones where there is a separation between the owners of the company and those who actually operate the business. C-corps are usually companies that are public, where anyone can buy ownership of the company through shares on the stock market. You can learn more about C-Corp and other tax brackets in our previous blog.

Intentional Accounting Can Help You Avoid the Hidden Tax

Intentional Accounting helps you avoid this costly tax by providing expert guidance on financial planning and compliance. We’ll work with you to document valid reasons for accumulating earnings, such as funding growth, preparing for emergencies, or paying off debt, ensuring your records meet IRS standards. With our proactive approach, you can confidently retain profits without the risk of unexpected tax penalties. Contact us today to schedule a consultation!